At Mercer Advisors, we go beyond just investment management to offer a fully integrated financial partnership for your nonprofit organization.

We believe our approach delivers a winning combination for nonprofits: an advisor with the size and scale of some of the largest endowments and foundations in the U.S., delivered locally with customized “one-stop-shop” financial services including investment management, board guidance, major gift planning expertise, and more.

And unlike big banks and brokers, we are an SEC-registered investment advisor, aligned with your values and legally obligated to act in your organization’s best interest.

Our Approach to Nonprofit Financial Advising

Our Institutional Scale Helps Deliver

Institutional-Grade Results

Institutional-Grade Results

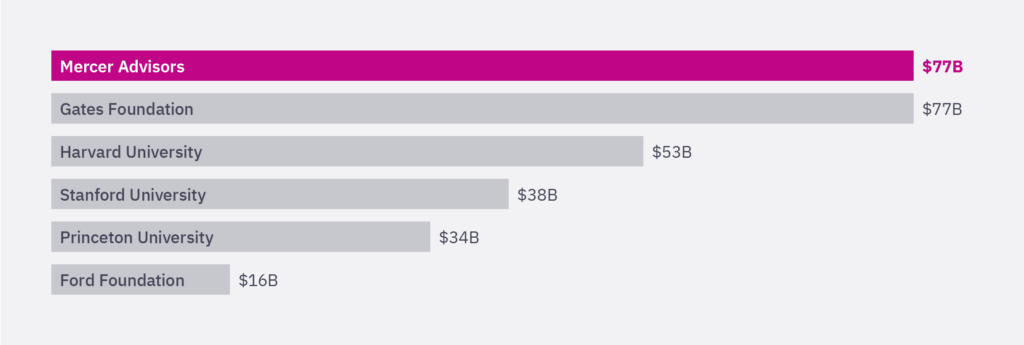

We match the size of some of the largest foundations and endowments in the U.S., which allows us to offer our institutional clients a wider range of investing solutions than what’s typically available from a smaller advisory firm (or what’s available as an individual going it on your own).

Source: Pensions & Investments (P&I) Research Center: Endowments and Foundations, ProPublica, and Mercer Advisors. Mercer Advisors assets refer to client assets under management and client assets under advisement (as of 9/30/2024) as well as assets gained from recent acquisitions where the advisory agreements have been properly assigned to Mercer Global Advisors, but the custodial accounts have yet to be transferred and/or the accounts have yet to be migrated to Mercer Global Advisors’ portfolio management system.

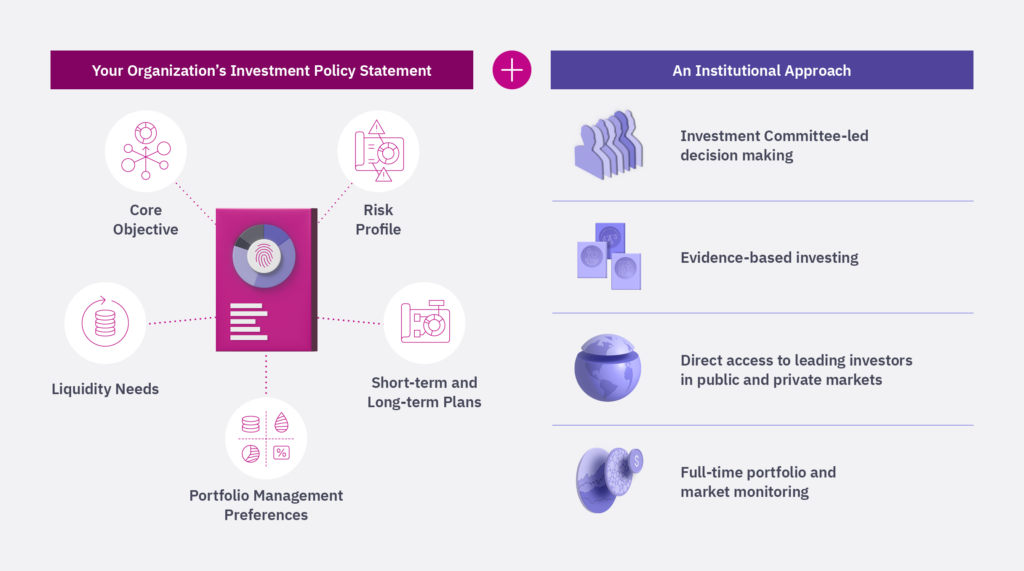

Honed over four decades and counting, our investing approach gives your organization:

- A 70+ person investment committee with decades of experience building portfolios

- A portfolio that leverages academic research and real-world data

- Access to top investment managers in public and private markets typically at lower fees and minimums

- Consistent and comprehensive market monitoring to optimize opportunities

This approach seeks to give you higher expected returns for lower costs. We want your money to go to your mission, not fees.

Portfolio and marketing monitoring is dependent upon the type of account (managed or unmanaged) and client objectives, therefore specific monitoring may vary from client to client.

FAQs About Our Approach

-

A nonprofit investment advisor is a financial professional who specializes in managing and optimizing the investment portfolios of foundations and nonprofit organizations. Their primary role is to ensure that your organization’s assets are strategically invested to help achieve long-term financial sustainability and support your organization’s mission.

Nonprofits need investment advisors because they often rely on endowments and investment income to fund their operations, programs, and initiatives. Investment returns can help you extend your mission. An experienced financial advisor for nonprofit organizations can help your organization maximize returns while managing risk, provide expertise regarding regulatory requirements, and help ensure your portfolio’s underlying investments align with your organization’s values.

-

Investment strategies for endowments and foundations differ from those of a typical individual investor in a few key ways, including, but not limited to, the following:

- Time Horizon: While an individual investor typically invests and plans against their life expectancy, a nonprofit’s time horizon is virtually unlimited, and they’ll need a longer-term strategy to match.

- Risk Tolerance: Because endowments and foundations generally need to produce steady income and maintain capital, they may have a lower risk tolerance than some individual investors, depending on age, income, savings, etc.

- Income Generation: Aligned with the above, endowments and foundations may seek more income-generating investments than an individual investor because of their need to provide stable income to support operational needs and grant-making activities.

- Regulatory Requirements: Endowments and foundations are subject to specific regulatory and reporting requirements, which can influence their investment strategies. For example, they may need to meet minimum spending requirements or adhere to donor stipulations. Individual investors are generally subject to fewer regulatory constraints.

- Values Alignment: Endowments and foundations often want to see their organization’s values expressed in their portfolios. This can include excluding certain securities and/or ensuring certain securities are included in their portfolio. An experienced financial advisor can bring these values into every part of the portfolio construction process and demonstrate an organization’s impact.

-

A well-crafted Investment Policy Statement (IPS) is essential for guiding the management of a nonprofit’s funds. Here’s why having an IPS is crucial for nonprofits:

- Duties and Expectations: The IPS specifically outlines what’s expected of the board and investment committee, ensuring everyone understands their roles and responsibilities. This clarity helps in maintaining accountability and ensuring that the organization’s financial resources are managed effectively.

- Investment Manager Responsibilities: The IPS helps ensure that managers are aligned with the organization’s goals and follow a consistent strategy. This helps with measuring performance and making informed decisions.

- Limiting Fiduciary Risk: Volunteer leaders in nonprofits often face fiduciary risks. An IPS helps limit these risks by providing a structured approach to investment management. By following the IPS, leaders can demonstrate that they are acting in the best interest of the organization.

-

Nonprofit boards have significant fiduciary responsibilities when managing investments to ensure the organization’s financial health and sustainability. These responsibilities are often summarized into three main duties: Duty of Care, Duty of Loyalty, and Duty of Obedience.

- Duty of Care includes prudent management, creating and adhering to an Investment Policy Statement (IPS), and regular monitoring.

- Duty of Loyalty includes avoiding conflicts of interest and providing transparency regarding investment decisions and processes.

- Duty of Obedience includes adhering to applicable regulatory requirements and ethical standards related to financial management.

-

Creating a sustainable financial plan is crucial for nonprofits to help ensure long-term stability and continued support for their missions. A fiduciary financial advisor for nonprofits can help by facilitating the following questions:

Isolating Goals: What are your nonprofit’s short-term and long-term goals? Do these align with your mission? Do you have an outline of specific steps you can take to achieve these goals?

Refining Your Investment Policy Statement: Have you reviewed your nonprofit’s Investment Policy Statement, and are your board members aware of its framework? Are its guidelines clear?

Aligned Investing: Does your portfolio support your short-term and long-term financial goals? Do the underlying investments within your portfolio support your organization’s mission?

Scenario Analysis: Have you stress-tested your existing plan and portfolio against potential challenges such as market downturns, unexpected loss ofmajor donors, etc.? Do you have contingency plans in place in case of such events?

Accountability: Do you regularly review and report on results? Are your staff members and board members aware of their fiduciary duties? Do you provide regular training to help ensure your team is in the know about best practices in the nonprofit space?