Next-generation philanthropy is redefining how charitable dollars are given, governed, and evaluated. As millennials and Generation Z gain financial influence — driven by the largest intergenerational wealth transfer in U.S. history — their expectations are reshaping long-standing philanthropic models.1

This shift is not cosmetic. For endowments, foundations, and nonprofits, it’s structural.

According to Cerulli Associates, more than $84 trillion in wealth is expected to transfer to younger generations by 2046, with a growing share flowing into donor-advised funds, family foundations, and impact-oriented vehicles.2 Institutions that fail to adapt risk losing relevance with younger donors who will define the next several decades of charitable capital.

Values first, institutions second

Unlike previous generations, younger donors tend to organize their giving around issues rather than organizations. Climate resilience, social equity, mental health, and basic human needs consistently rank among their top priorities.

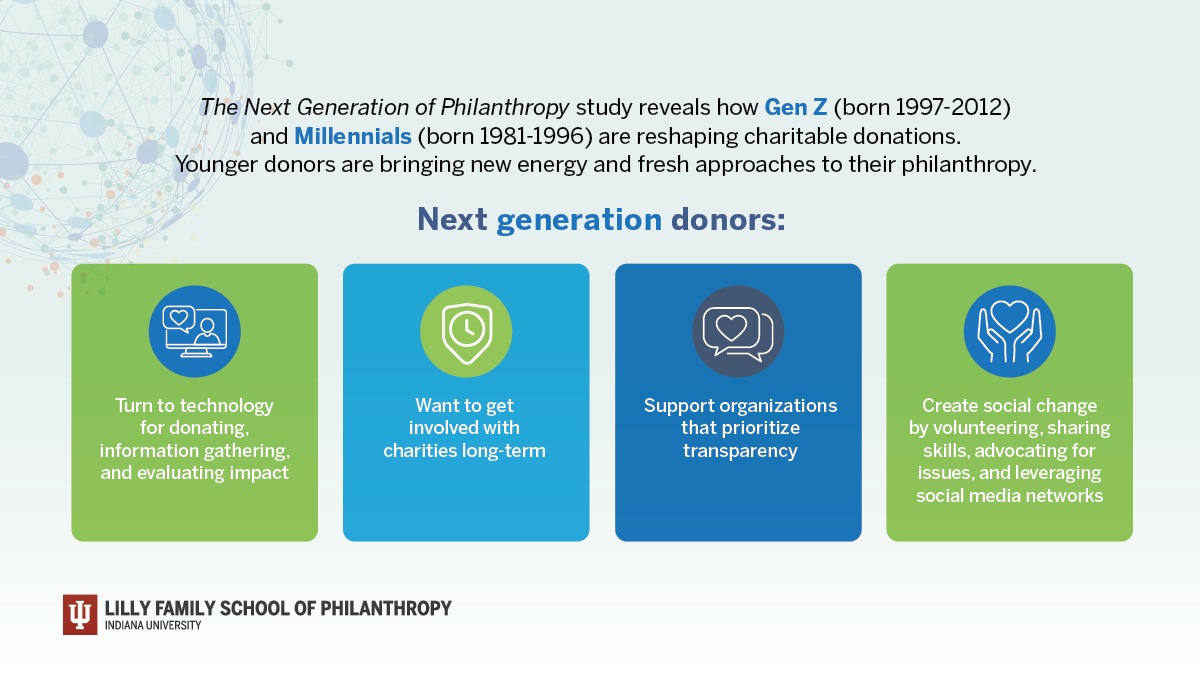

Research supported by the Lilly Endowment and peer philanthropic institutions shows that younger donors are significantly more likely to support causes that demonstrate:

- Clear alignment with personal values

- Tangible, community-level outcomes

- Transparency in governance and spending3

Technology is the front door to giving

For younger donors, technology is not supplemental; it’s foundational. Social platforms serve as discovery engines, accountability tools, and mobilization channels. Causes are often introduced through peer networks, creators, or issue-based communities, with action following quickly through mobile-optimized donation tools.

The Indiana University Lilly Family of Philanthropy reports that nearly 60 percent of millennial donors discover causes through social or digital channels, compared with less than 30 percent of baby boomers.3 Speed, clarity, and accessibility matter.

At the same time, skepticism is high. Younger donors want plain-language explanations of how funds are used, who makes decisions, and whether stated outcomes are achieved. Impact claims are expected to be verifiable, not aspirational.

AI handles data. Humans build trust.

Artificial intelligence has moved from experimentation to infrastructure. By 2026, most mid- to large-sized nonprofits are using AI-enabled tools to:

- Analyze donor behavior and engagement patterns

- Predict giving likelihood and appropriate ask levels

- Automate administrative and reporting tasks

- Personalize outreach at scale

High-performing fundraising organizations understand the boundary. AI improves precision and efficiency, but it does not replace human connection.

Technology can identify the right donor at the right time. Trust is built by people — whether at a community event, a site visit, or a one-on-one conversation — who help donors understand their role in advancing a mission. AI strengthens face-to-face fundraising; it does not eliminate it.

From black-tie galas to participatory philanthropy

Traditional fundraising galas still play a role, particularly for legacy donors and major gift cultivation. For many younger donors, highly produced events feel disconnected from impact.

What resonates more strongly for younger donors is participatory philanthropy: direct involvement in the work being funded. This can include volunteering, site visits, donor advisory councils, peer-to-peer campaigns, or collaborative grantmaking.

Studies from the Stanford Social Innovation Review and the Lilly Family School of Philanthropy show that donors who participate beyond financial contributions demonstrate higher retention and lifetime giving. Engagement creates ownership, not just attendance.

Smaller, community-centered gatherings often outperform large-scale events when measured by engagement depth and donor loyalty.

Digital-first, not digital-only

Next-gen philanthropy is best described as digital-first and human-centered.

Recurring monthly giving, crowdfunding, and donor-advised funds are baseline expectations. Data analytics and automation increasingly support stewardship and communications behind the scenes.

In-person interaction remains critical. The stronger donor journeys blend digital touchpoints with authentic human engagement — online discovery followed by real-world connection and feedback loops that show progress over time.

Participation is the new currency

Millennial and Gen Z donors want influence, not just recognition. They are drawn to:

- Participatory grantmaking models

- Shared decision-making structures

- Donor collaboratives and learning communities

This mindset extends to corporate philanthropy as well. Younger donors expect companies and nonprofits to align around purpose, transparency, and outcomes — not just brand visibility. Authentic partnerships matter more than logo placement.

What this means for endowments and foundations

For institutional philanthropy, next-generation donors present both opportunity and urgency.

Organizations that succeed will prioritize:

- Clear, accessible impact reporting

- Digital infrastructure that supports ease and recurring engagement

- Opportunities for donors to participate beyond writing a check

- Blended experiences that connect online engagement to real-world outcomes

The next generation is not disengaged from philanthropy. They are redefining it. For endowments and foundations willing to evolve, the reward is deeper relationships and more durable impact.

For more information or to connect with the Mercer Advisors Endowment and Foundation team, let’s talk.

1 “The Greatest Wealth Transfer in History Is Here, With Familiar (Rich) Winners,” The New York Times, updated May 23, 2023.

2 “U.S. High-Net-Worth and Ultra-High-Net-Worth Markets Report,” Cerulli Associates, 2025.

3 “Next Generation donors’ charitable giving interests and approaches examined in new study from Indiana University Lilly Family School of Philanthropy and DAFgiving360,” Lilly Family School of Philanthropy, Jan. 29, 2025.

Explore More

Beyond Grants: Using Program-Related Investments to Drive Mission Results

January 29, 2026

All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. Some of the research and ratings shown in this presentation come from third parties that are not affiliated with Mercer Advisors. The information is believed to be accurate but is not guaranteed or warranted by Mercer Advisors. Content, research, tools and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. For financial planning advice specific to your circumstances, talk to a qualified professional at Mercer Advisors.